ClearBooks

ClearBooks is one of the less well-known accounting software options available in the UK, but it’s still well worth considering whether you’re a freelancer or running a small business. The people originally behind ClearBooks are now running a challenger bank called CountingUp, which brings accounting and banking under one umbrella - they’re a brand to look out for in the future.

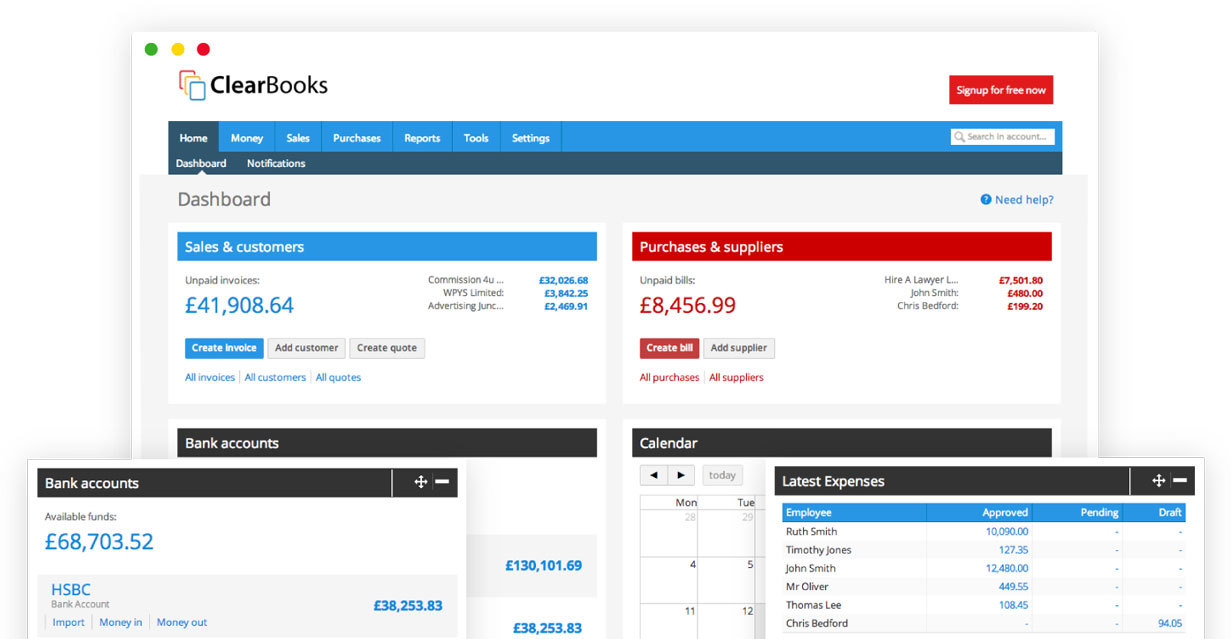

ClearBooks has a simple, bright interface that will be familiar if you’ve used products from companies like Zoho in the past. Its invoicing and quoting systems are intuitive, and it offers a solid set of reports to help you understand your financial position (although, like most of its competitors, ClearBooks does not currently offer cashflow forecasting). Multi-currency support is available for an extra charge, as is a payroll integration.

However, there are two places in which ClearBooks falls short. Perhaps the most important is a lack of mobile app, which seriously limits users’ ability to track expense receipts on the go. The other is third-party integrations. Where competitors like Xero offer hundreds of integrations allowing you to plug additional tools into your accounting software, ClearBooks lacks this functionality. This could be a dealbreaker if you need to move seamlessly between different packages.

Best for

Freelancers and small businesses

Features

- Invoicing

- Quotes

- Double entry

- Expense management

- Inventory tracking

- Company reports

- Cashflow forecast

- Customer statements

- Online VAT

- Making Tax Digital compliant

- Time tracking

- Multicurrency

- Bank reconciliation

- Multi user

- Payroll

- Mobile app

- Live support

- Integrates with CRM

- Free trial

Deployment

Cloud, SaaS, Web